SK Hynix is making headlines after posting record-breaking Q2 2025 results, with shares trading around 353,000 KRW as of September. The company's dominant position in HBM (High Bandwidth Memory) markets and surging AI memory demand are driving impressive gains. Let's dive into the latest financial analysis and H2 investment outlook.

Record-Breaking Q2 2025 Performance

SK Hynix absolutely crushed it in Q2 2025. The numbers speak for themselves: revenue hit 22.23 trillion KRW, operating profit soared to 9.21 trillion KRW, and net income reached 6.99 trillion KRW. With an operating margin of 41.4%, this represents exceptional profitability that's rare in the memory semiconductor space.

Year-over-year growth tells an even more compelling story. Revenue jumped 35.4% while operating profit skyrocketed 68.4%. Net income surged 69.8%, primarily driven by expanded HBM and premium DRAM sales. Think of it like a premium restaurant commanding higher margins than fast-food chains – SK Hynix is leveraging cutting-edge technology to generate superior returns.

Quarter-on-quarter growth also remained robust, with revenue up 26.0% and operating profit climbing 23.8%. While net income dipped 13.7% QoQ due to temporary tax adjustments and FX volatility, the underlying operational profitability continues strengthening – that's what really matters here.

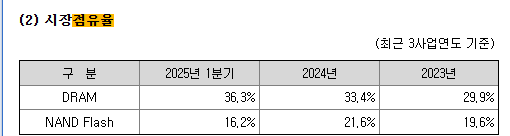

HBM Market Dominance Fuels Growth

So what's driving these stellar results? It all comes down to SK Hynix's commanding presence in the HBM market. HBM is the ultra-fast memory that AI accelerators absolutely need – it costs 10x more than regular memory but delivers performance to match.

According to UBS Securities, SK Hynix is expected to capture approximately 56% of the global HBM market share. The company serves as a key supplier to NVIDIA, providing HBM3E products in volume. With NVIDIA holding roughly 80% of the AI chip market, SK Hynix couldn't ask for a better strategic partner.

The future outlook looks even brighter. Management forecasts the HBM market will grow at 30% annually through 2030. This year alone, they're planning to roughly double HBM revenue compared to 2024. With next-gen HBM4 launching next year, SK Hynix should maintain its technological edge for the foreseeable future.

Investment Metrics: Still Undervalued?

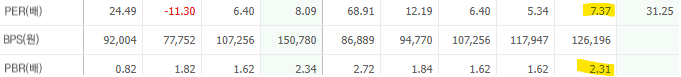

Let's crunch the key financial numbers investors care about. Based on Q2 2025 data, SK Hynix trades at 7.37x P/E and 2.31x P/B – both well below semiconductor sector averages.

The P/E ratio shows how the current stock price compares to annual earnings per share. At 7.37x, it would take about 7.4 years of current earnings to equal the company's market value. Put simply, you'd recoup your investment through company profits in roughly 7.4 years. The lower the P/E, the better the value. Compared to typical growth stocks trading at 15-20x P/E, this looks quite attractive.

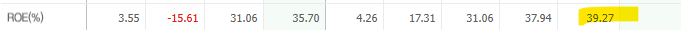

The P/B ratio of 2.31x means the stock trades at 2.3 times book value – reasonable for a tech-intensive business. But here's the real standout: ROE (Return on Equity) hits 39.3%. This measures how efficiently the company generates profits from shareholder investments. While 15%+ is considered excellent, 39% represents truly outstanding profitability.

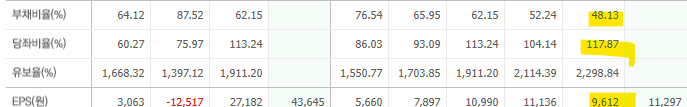

Financial stability looks solid too. The debt ratio improved to 48.1% from 52.2% last quarter, while the current ratio of 117.9% indicates healthy short-term liquidity. EPS of 9,612 KRW demonstrates a strong earnings foundation.

Dividend yield sits at 0.91% with 375 KRW per share paid consistently. The 2025 dividend payment date is scheduled for September 30th. As earnings continue growing, dividend increases seem likely down the road.

H2 2025 Investment Outlook & Risk Factors

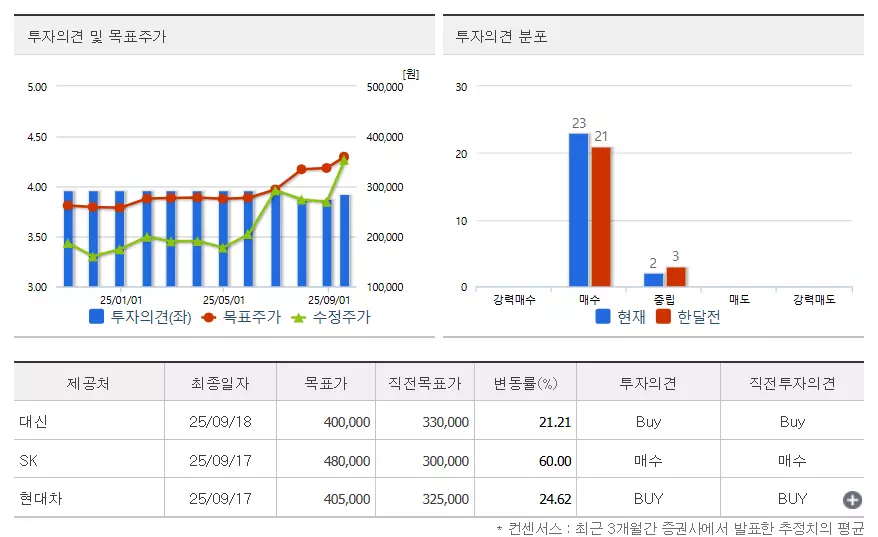

Is now the right time to buy? Several brokerages have raised price targets to 400,000-480,000 KRW range. At current levels around 350,000 KRW, there appears to be upside potential remaining.

H2 should see accelerating memory demand as customers launch new products and compete to enhance AI model performance. Sovereign AI investments across various countries should provide additional long-term tailwinds.

That said, some risks deserve attention. Short-term momentum fatigue could set in, and semiconductor cycles are notoriously volatile – corrections can happen quickly. Geopolitical tensions with China and FX fluctuations add uncertainty too.

For tactical investors, here's what makes sense: If you're already holding shares, consider taking partial profits while keeping core positions for the long haul. New investors should avoid FOMO buying – instead, use 3-4 tranches to dollar-cost average and reduce risk.

Technical Analysis & Trading Strategy

Price Action: After hitting fresh highs at 367,500 KRW in September, short-term overheating signals are emerging. Current levels around 353,500 KRW reflect continued strength but suggest profit-taking by short-term traders.

Key Indicators:

• RSI approaching 70 (overbought territory) – typically signals near-term exhaustion

• MACD trending upward but showing signs of potential reversal from extreme levels

• Stochastic oscillator in overheated range – watch for correction signals

Trading Levels:

• Buy Zone: Wait for pullback to 320,000-330,000 KRW support before adding positions

• Sell Signal: Short-term holders should consider profit-taking at current levels, especially if RSI exceeds 70

• Stop Loss: Break below 330,000 KRW could trigger deeper correction – manage risk accordingly

Bottom line: This looks like a consolidation/profit-taking phase rather than a chase-the-rally moment. Patient investors should wait for better entry points during any pullback.

Long-Term Investment Perspective

From a strategic standpoint, SK Hynix remains compelling for long-term investors. The AI revolution is still in early innings, and demand for high-performance memory like HBM should continue expanding. HBM4 production starting in 2026 should cement the company's technological leadership.

The company sits at the sweet spot of two major trends: the semiconductor upcycle and the AI boom. However, always invest within your risk tolerance and time horizon. The memory business can be cyclical, so position sizing matters.

While dividend yields aren't spectacular, the consistent 375 KRW per share provides some income for buy-and-hold investors. As profits grow, dividend growth should follow.

Sources

Financial Supervisory Service Electronic Disclosure System (DART)

Semiconductor Equipment and Materials International (SEMI)

SK Hynix IR Materials

Naver Finance

This content is for informational purposes only. Investment decisions should be made based on your own research and judgment.